gilti high tax exception tested loss

An annual 250 deduction from property taxes is provided for the dwelling of a qualified senior citizen disabled person or their surviving spouse. GILTI hightax exception together with the subpart F high- tax exception have the potential to broadly - expand a CFCs exempt income where it operates in sufficiently high.

Harvard Yale Princeton Club Ppt Download

Since the introduction of the Global Intangible Low-Taxed Inclusion GILTI in the 2017 Tax Cuts and Jobs Act TCJA taxpayers have eagerly.

. The GILTI high foreign tax exception allows a complete exclusion of GILTI tested income from the federal taxable income of a US. To qualify you must be age 65 or older or a. Shareholder of a controlled foreign corporation CFC.

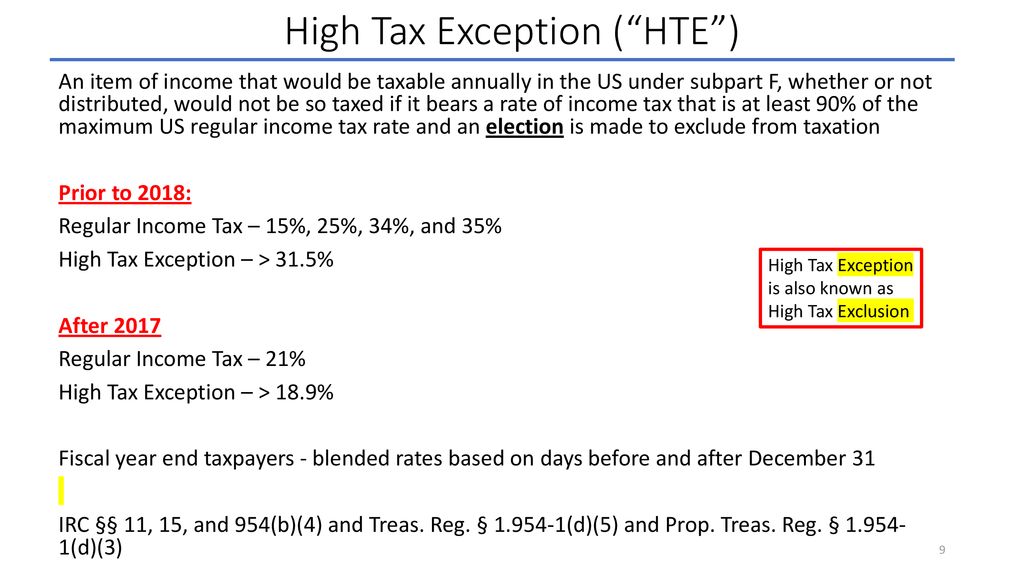

Effect on tested losses. So-called subpart F high tax exception the latter the GILTI high tax exclusion6 Under the subpart F high tax exception a taxpayer may elect to exclude income from subpart F income if. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the.

The Proposed Regulations applied a QBU-by-QBU approach to identify the relevant items of income that may be eligible for the GILTI high-tax. Shareholder that owns a CFC. On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final.

GILTI High Tax Exception Considerations. This section provides rules for determining the tested income or tested loss of a controlled foreign corporation for purposes of determining a United States shareholders net. New Jersey Property Tax Benefits 100 Disabled Veterans or Surviving Spouses 100 Disabled Veterans or Surviving Spouses - 100 totally disabled war veterans or their unmarried surviving.

The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum US. Elective GILTI Exclusion for High-Taxed GILTI. Yet the combination of the subpart F income high-tax exception and GILTI high-tax exclusion into a unified high-tax exception may surprise many taxpayers.

The New Tested Unit Standard. Here are the programs that can. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments.

International Tax Reform Proposals From The House The Senate And The Biden Administration True Partners Consulting

How Foreign Subsidiary Owners Can Plan For Gilti Hte

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Harvard Yale Princeton Club Ppt Download

High Tax Exception Exonerates The Gilti

Insight Fundamentals Of Tax Reform Gilti

The Irs Clarifies The Regulations For The High Tax Exception To Gilti Sf Tax Counsel

Harvard Yale Princeton Club Ppt Download

Us Tax Reform Gilti Uncertainties International Tax Review

Insight Fundamentals Of Tax Reform Gilti

Gilti Regime Guidance Answers Many Questions

Is The Irs Feeling Gilti New Guidance And Potential Relief

Gilti Global Intangible Low Taxed Income Youtube

954 C 6 Considerations For 2021 Global Tax Management

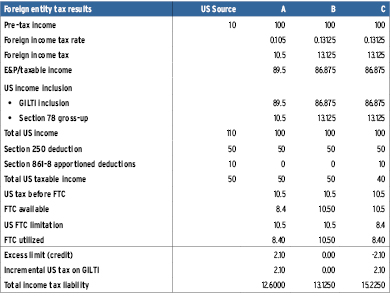

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

Is The Gilti High Tax Exception A Benefit For Controlled Foreign Corporations

Insight Fundamentals Of Tax Reform Gilti

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling